seattle payroll tax calculator

The second is a volume tax called the spirits liter tax which is equal to 37708 per liter retail or 24408 per liter restaurants and bars. For more information please visit our Quick Books Payroll Software page.

However you still have to factor in Unemployment Insurance and Workers Compensation Tax.

. Important note on the salary paycheck calculator. Seattle Payroll Tax Calculator. For example in 2021 businesses that had 7 million or more in Seattle payroll expenses in 2020 would apply the tax rates based on their 2021 Seattle payroll expense of employees with annual compensation of 150000 or more.

While local sales taxes in Seattle Tacoma and some other metro areas are significantly higher than the national average all. Employers can file a tax return online here or manually by downloading the form here and providing a written check. These changing rates do not include the social cost tax of 122.

As the employer you must also match your employees contributions. Apr 5 2022 - Seattle Payroll Tax Calculator. Well do the math for youall you need to do is enter the applicable information on salary federal and state.

There are two taxes on spirits in Washington. Washington State Spirits Tax. It should not be relied upon to calculate exact taxes payroll or other financial data.

2021 Social Security Payroll Tax Employee Portion Medicare Withholding 2021 Employee Portion To contact the Seattle Department of Revenue please call 360-902-9620. The payroll expense tax in 2022 is required of businesses with. Paid Family and Medical Leave PFML 06.

Compensation in Seattle for the current calendar year 2022 paid to at least one employee whose annual compensation is 158282 or more. The first is a sales tax of 205 for retail sales and 137 for sales made in restaurants and bars. You can view a sample of the payroll tax return here.

7386494 or more of payroll expense in Seattle for the past calendar year 2021 and. If there are no. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

Calculate Payroll Factor Divide line 2a by the amount in line 2b this is your payroll factor. Total annual payroll expense for employees who have annual compensation of 400000 or more in the current year. To use our Washington Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimatesIt should not be relied upon to calculate exact taxes payroll or other financial data. Washington State Unemployment Insurance varies each year. Under FICA you also need to withhold 145 of each employees taxable.

After a few seconds you will be provided with a full breakdown of the tax you are paying. This Washington hourly paycheck calculator is perfect for those who are paid on an hourly basis. Also enter this amount calculated as a percentage on line 2c.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. Employers in the first bracket will be taxed. Skip to main content.

Calculate your take home pay after federal Washington taxes deductions and exemptions. For 2022 the wage base is 62500. Employers with less than 7 million in.

These calculators are not intended to provide tax or legal advice and do not represent any ADP. Lawmakers have considered introducing a state income tax in recent years but no attempt has been successful thus far. However businesses must use the current years compensation paid in Seattle to determine the payroll expense tax due for the year.

How to File a Tax Return. The maximum an employee will pay in 2022 is 911400. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

This tax is paid to the City of Seattle and will require that businesses have an account with this agency. These calculators are not intended to provide tax or legal advice and do not represent any ADP. Updated for 2022 tax year.

Our payroll software is QuickBooks compatible and can export payroll data to QuickBooks. Switch to Washington salary calculator. Rates also change on a yearly basis ranging from 03 to 60 in 2022.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Washington Hourly Paycheck Calculator. If the business has no employees then there is no payroll factor.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Washington. Our washington salary tax calculator has only one goal Apr 5 2022 - Seattle Payroll Tax Calculator. Important note on the salary paycheck calculator.

For annual and hourly wages. Details of the personal income tax rates used in the 2022 Washington State Calculator are published below the. Tax year Tax name Percent of taxable wage Up to taxable wage.

The Washington Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Washington State Income Tax Rates and Thresholds in 2022. The seattle payroll tax is measured by the payroll expense of the business times a rate that varies based on the businesss total seattle payroll expenses and the compensation paid in seattle to each employee whose annual compensation. The amount in line 2a plus payroll for employees in all locations other than the city.

Whether youre paying them hourly on a salary or by another method. Employers must calculate the Seattle payroll for all employees including those earning less than 150000.

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Filing A Business Tax Extension 2018 Seattle Cpa

Nanny Tax Payroll Calculator Gtm Payroll Services

If You Are A Business Owner In Seattle Wa And Have Questions About Seattle Or Washington State Sales Tax Contact Us Budget Planning Sales Tax Accounting Firms

How To Calculate Food Cost With Calculator Wikihow

Washington Paycheck Calculator Adp

Tax Calculator Estimate Your Taxes And Refund For Free

Nanny Tax Payroll Calculator Gtm Payroll Services

How Much Does A Small Business Pay In Taxes

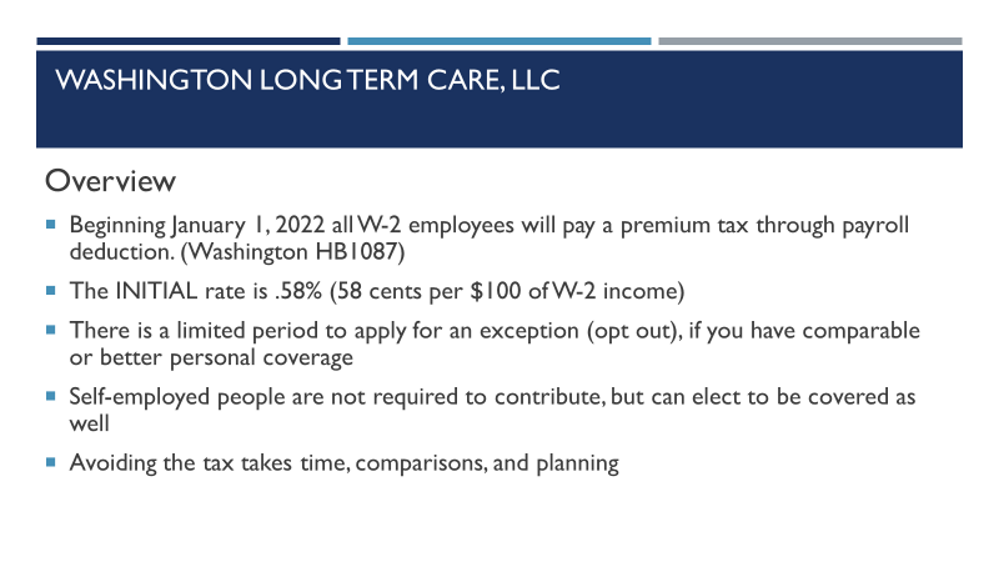

Payroll Washington Long Term Care Llc

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Washington Paycheck Calculator Smartasset

38 000 After Tax Us Breakdown August 2022 Incomeaftertax Com

Here S How Much Money You Take Home From A 75 000 Salary